BIOPSY-19 🧪 Deploy Bio V1 on Solana and Base

Summary

This proposal outlines the deployment of Bio Protocol V1 ("Bio V1”), the first major upgrade to the Bio Protocol. It specifically proposes the first phase of deployment, the release of the Bio V1 Launchpad.

The Bio Launchpad is a token launchpad for tokenized R&D networks known as BioDAOs. It allows DAOs to distribute their tokens, build a treasury, attract an early community of token holders and gain access to an automated liquidity layer to ensure stable trading conditions post-launch.

At its core, the Bio Launchpad is designed to help scientists raise funds for their research, with the eventual goal of creating value from that research, and capturing and distributing that value via commercial successes. BIO token holders guide which BioDAOs launch and how they grow.

This proposal is broken down into the following sections:

- Bio V1 Launchpad Mechanics

- The First BioDAOs Proposed for Curation

- Bio V1 Parameters

- Looking Ahead

1. Bio V1 Launchpad Mechanics

Key Goals of Bio V1 Launchpad:

-

Curation: Enable the BIO community to signal support to high-potential BioDAOs for launch.

-

Initial Funding: Provide seed capital to new BioDAOs at inception through community-driven funding rounds.

-

Demand: Create early demand and engagement for BioDAOs by involving BIO holders from the start.

-

Ease of Use: Ensure a simple, user-friendly process for both project teams and contributors, lowering barriers to participation.

-

Future Fundraising: Set the stage for successful future fundraising rounds by establishing market interest and a support base.

-

Team Alignment: Align BioDAO founding teams with community investors, incentivizing teams to deliver value (e.g. teams also hold tokens that vest or depend on Launchpad outcomes).

-

Launchpad Retention: Allow the Bio Protocol community to retain an interest in each launched BioDAO, so network value grows with each success.

-

Reliable Liquidity: Ensure new BioDAO tokens have deep liquidity post-launch, preventing illiquid markets and enabling fair price discovery.

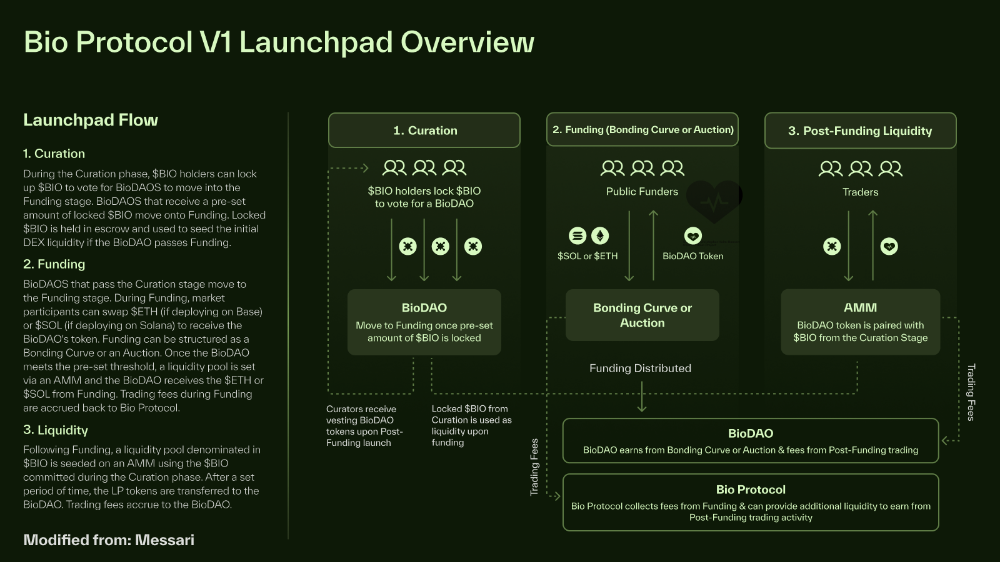

The Launchpad rollout is structured in three phases: Curation, Funding, and Liquidity. In Curation, BIO holders lock BIO tokens to signal support for a project and “curate” it for launch. If a project meets the curation requirements, it proceeds to Funding, where it raises capital either via a price threshold auction or a bonding curve sale. Finally, upon a successful raise, the Liquidity phase releases the new BioDAO’s token into the market by seeding an on-chain liquidity pool. Below is a detailed breakdown of each phase:

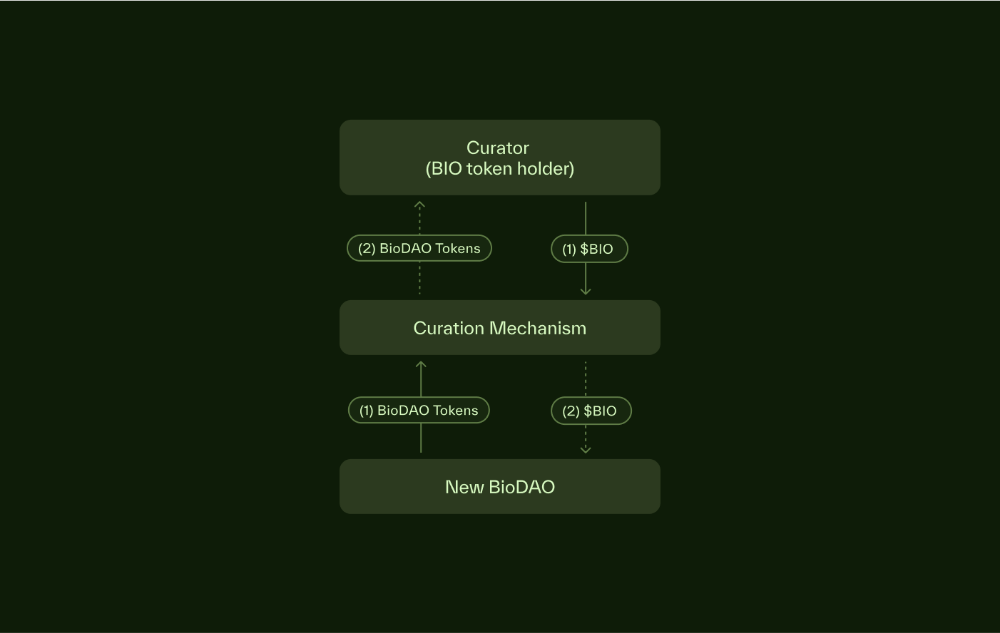

- Curation: BIO token holders determine which new BioDAOs gain access to the launchpad. When a new BioDAO enters the curation phase, it allocates a portion of its token supply for curators. BIO token holders deposit their BIO tokens to signal support. Users who withdraw their deposited BIO before the conclusion of curation may be subject to an adjustable withdrawal fee, accrued by the protocol. Once a threshold is reached, curated BIO tokens are locked, triggering the start of fundraising. BIO tokens are locked for a pre-set period of time as determined by the BioDAO; for the first batch of DAOs, curated BIO will be locked for 60 days. After a successful fundraise, vesting BioDAO tokens are distributed to curators, and the locked BIO is allocated to the BioDAO for liquidity in an AMM. BioDAO tokens received by BIO curators are subject to a vesting period with a cliff. Initially these will be set to 6 month vesting and 3 month cliff. Should the BioDAO fail to raise the minimum required funds within the designated period, curators may reclaim their deposited BIO after the lock period has ended. A whitelist feature (detailed below) enables projects to designate select community members for early participation. After the whitelist window, the curation phase opens to all BIO holders.

-

Whitelist: Before public curation begins, a whitelist period is offered to selected contributors. This whitelist typically includes project-affiliated individuals and large BIO holders (e.g. anyone holding ≥1M BIO). Whitelisted participants are granted early access and collectively can contribute up to 50% of the total curation allocation. This ensures that core community members and strategic partners have a chance to support the project first. (Whitelist contributions are capped by a set allocation of 50,000 BIO; any unused portion opens to the public.)

-

Funding: Once curation succeeds, the project moves on to raise capital from the broader crypto market. Each BioDAO can choose one of two funding models for this phase:

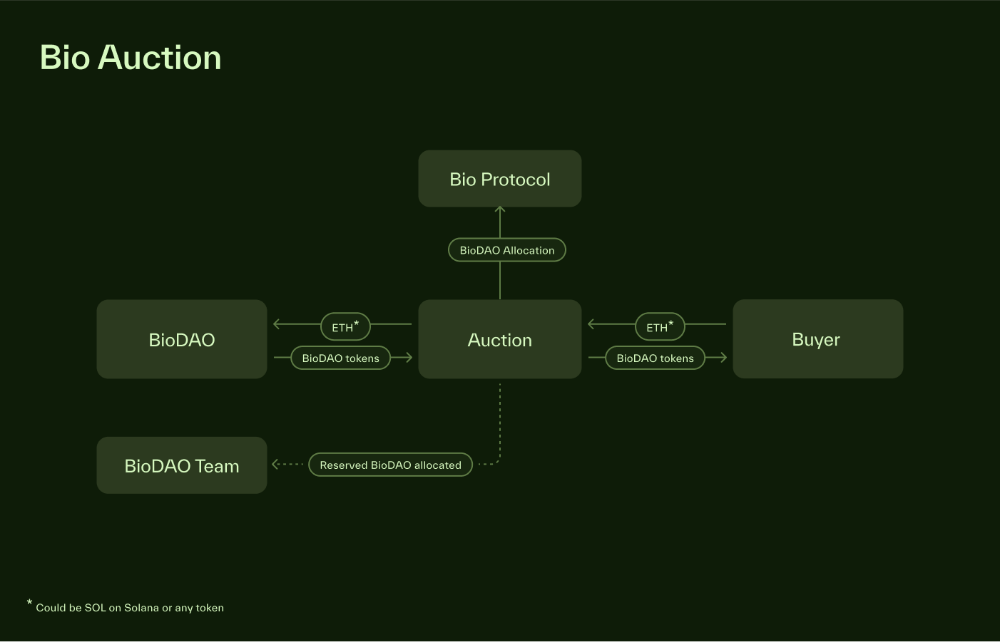

- Auction: The auction runs for a predetermined period (e.g., 7 days) where participants deposit a base currency (ETH on Base or SOL on Solana) to buy the BioDAO’s tokens. The auction is uniform-price, meaning all participants receive the new tokens at the same final price determined at the end of the auction (i.e., everybody pays the same clearing price). This model ensures a fair price discovery based on demand. Participants can freely join or leave the auction and the final price is set by the total amount raised versus tokens available. (If the auction does not meet a minimum raise threshold set by the project, the outcome is considered unsuccessful as described below.)

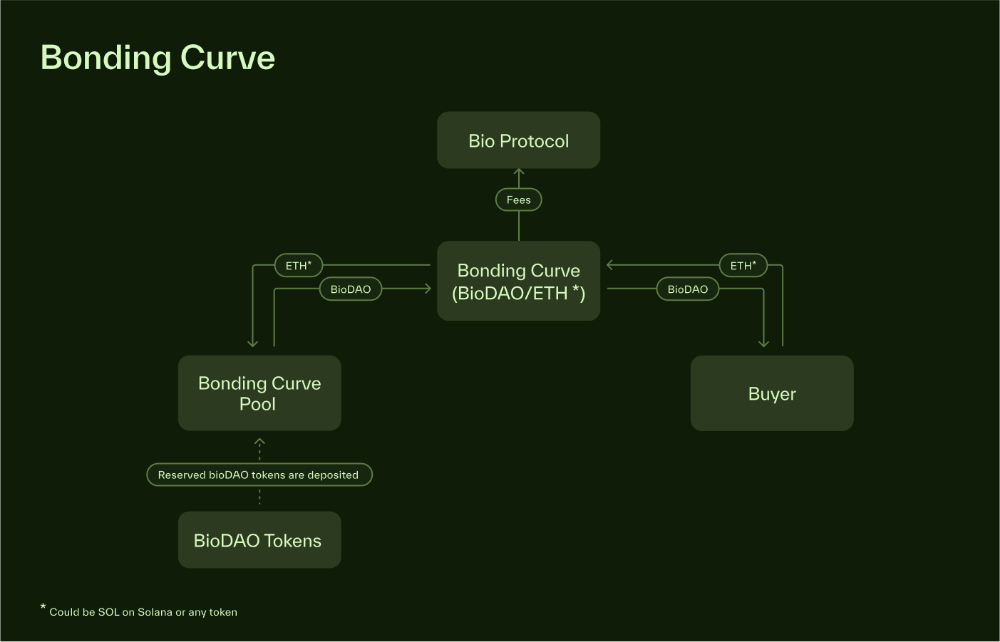

- Bonding Curve: A constant product bonding curve sale running until the closing valuation is reached. In this model, users can buy tokens continuously from a smart contract, where the price of the BioDAO token increases exponentially as more tokens are purchased (reflecting increasing demand). The bonding curve is parameterized with a fully diluted valuation (FDV) target; reaching this target (i.e. selling the allotted tokens such that the implied market cap hits the FDV) will close the sale early (“sell out” the curve). All funds raised (ETH/SOL) are aggregated for the BioDAO’s treasury. Following the bonding curve reaching its target, Bio Protocol receives its allocation of BioDAO tokens.

-

Outcomes: The two first phases, Curation and Funding, have two outcomes each. Both phases can be successful and unsuccessful.

-

Curation (successful): Once the curation threshold is reached, the committed BIO tokens are locked, triggering the start of fundraising.

-

Curation (unsuccessful): If the BioDAO fails to raise the minimum required funds within the designated period, curators may reclaim their deposited BIO and the curation may be closed.

-

Funding (successful): Upon a successful fundraise (either the auction concluded above the minimum or the bonding curve reached its goal) the liquidity phase is initiated.

-

Funding (unsuccessful): If the funding phase fails to meet its minimum requirements, the launch process will not proceed to liquidity. For an auction, this means if the total funds raised are below the pre-set minimum goal (soft cap), the auction is deemed unsuccessful and contributors can reclaim their ETH/SOL; in such a case, all BIO curators from the previous stage would also be able to reclaim their locked BIO (since the project isn’t launching) after the lock period ends. In a bonding curve scenario, if the bonding curve never reaches the target (i.e. the curve does not sell out), the curators will be allowed to withdraw their BIO at the end of the lock period. The bonding curve and the DAO curation itself will continue to exist and trade in perpetuity. Should the DAO progress and the bonding curve still close, users can still commit to the DAO curation and close the curation and bonding curve phase simultaneously, advancing the project to the next stage.

-

-

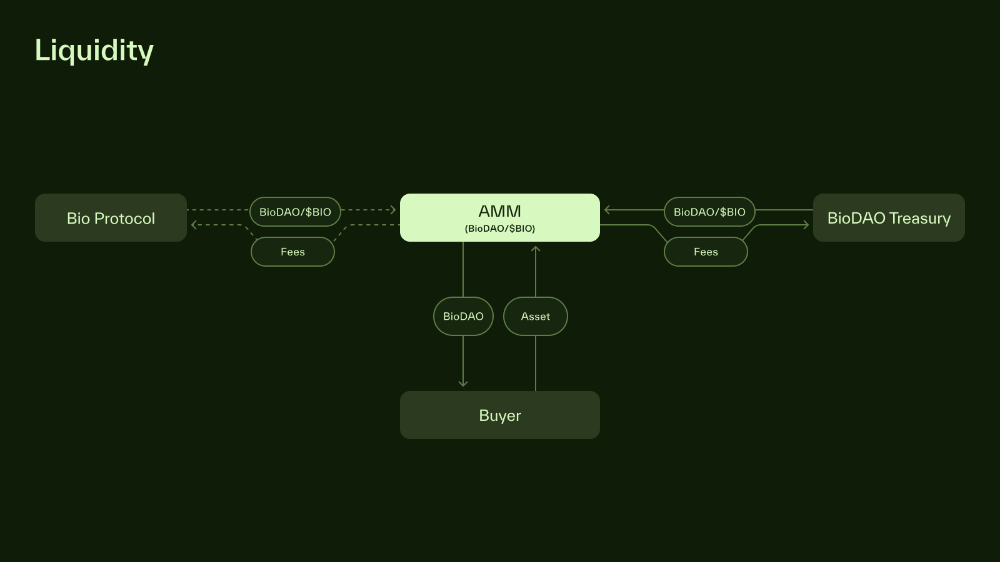

Liquidity: Upon a successful fundraise (either the auction concluded above the minimum or the bonding curve reached its goal), the new BioDAO’s tokens are released into the market with initial liquidity. The BIO tokens collected from curators in the curation phase now become part of an automated market maker (AMM) liquidity pool, paired with a portion of the BioDAO’s own tokens. In practice, the BioDAO will allocate a certain amount of its token supply to pair with the locked BIO, seeding a BIO/BioDAO Token liquidity pool on the target chain’s DEX. This provides immediate, reliable liquidity for trading. The ETH or SOL raised in the funding phase is sent to the BioDAO’s treasury (to be governed by the community). Bio Protocol may provide additional liquidity or market-making support to the new pool. Any such support, if approved by the BIO community, would further stabilize the market for the new token. From this point on, the BioDAO’s token trades freely, and liquidity providers (including the BioDAO itself, which supplied the initial liquidity) earn trading fees. The Launchpad’s role for this BioDAO is complete, and the BioDAO can continue to grow independently.

Bio Protocol Value Accrual: Bio V1 Launchpad not only benefits new BioDAOs but also accrues value to BIO and its community treasury. Several mechanisms ensure that the success of launched BioDAOs feeds back into the Bio Protocol ecosystem:

--

Due to snapshots size limit, please continue reading the full proposal on commonwealth.

If this proposal passes the complete set of information from the linked commonwealth proposal is approved.

Off-Chain Vote

Timeline

Mar 28, 2025Proposal created

Mar 28, 2025Proposal vote started

Mar 31, 2025Proposal vote ended

Mar 31, 2025Proposal updated