Author

Mark11 (Fraximalist)

Summary

This proposal (part of three separate proposals) seeks to add 2pool (BB-E-FRAX | BB-E-USDC) on Balancer to FXS gauge controller.

Background & Motivation

Frax has become the master of the Curve wars and Balancer is another frontier. There is a lot of utility and liquidity over at Balancer making use of its unique product offerings. For example things like 20%/80% pools which many protocols prefer for governance token liquidity, and LBP for token launches coordinated through PrimeDAO and Fjord Foundry. Also protocols like Olympus are stationing their main liquidity pools over on Balancer.

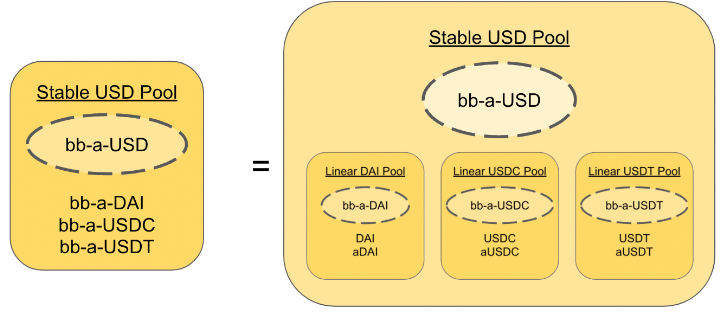

Balancer also has the ability for protocols to have deployed liquidity in boosted pools such as the pool referred to in this proposal. These pools have the following advantages:

High Capital Efficiency Boosted Pools are designed to deliver high capital efficiency by enabling users to provide trade liquidity for common tokens while forwarding idle tokens to external protocols. This gives liquidity providers the benefits of Euler on top of the swap fees they collect from trades.

Superfluid, Consolidated Liquidity Nesting pool tokens creates a powerful avenue to make swaps between any stablecoin and underlying borrowing protocol tokens in the Boosted Pool. On top of that, any token in a pool with a Boosted Pool Token can tap directly into the underlying tokens.

Example of an already deployed USD pool

We need FRAX to be everywhere and Balancer is likely to be a part of the overall mix when it comes to medium-term liquidity destinations.

Relevantly, Aura proposes to be the Convex of the Balancer ecosystem and AURA holders direct the veBAL locked as auraBAL. It can be more economical to bribe AURA holders than veBAL holders directly to direct BAL rewards to a preferred pool.

Presently there is a profitable opportunities for bribing veBAL or veAura holders.

The 2pool The 2pool (BB-E-FRAX | BB-E-USDC) would be initially funded by an AMO deposit of liquidity and allow trades between FRAX and USDC in a capital efficient manner - while earning lending interest from Euler. It would also allow nesting of other tokens with the 2pool for example frxETH-2pool, FXS-2pool, FPI-2pool, etc, and allow direct trading between USDC or FRAX and the nested token (for example ETH->FRAX, ETH->USDC). This can also serve as a rail between Curve liquidity and Balancer liquidity.

The 2pool has been deployed by Balancer core team at Balancer .

A veBAL gauge is being voted on here and is well supported by Balancer governance here Snapshot .

Security & Risk

The Balancer v2 codebase was audited by Trail of Bits and Open Zepplin in 2021 - see Audits - Balancer.

Proposal

- For: Approve FXS gauge for 2pool (BB-E-FRAX | BB-E-USDC)

- Against: Do nothing

Off-Chain Vote

Timeline

Feb 21, 2023Proposal created

Feb 21, 2023Proposal vote started

Feb 26, 2023Proposal vote ended

Nov 21, 2025Proposal updated