RFP-29: Chaos Labs - Interest Rate Parameter Optimization

Abstract

Chaos Labs proposes a strategic collaboration with Radiant, aimed at advancing the optimization and decentralization of interest rate curves within the Radiant Protocol markets. Chaos Labs, with its deep expertise in risk management for lending protocols across various blockchains, offers a unique and specialized framework tailored for interest rate optimization.

About Chaos Labs

The Team

Chaos Labs is staffed with a distinguished team, boasting a range of professionals from researchers to security experts. Our team's background spans prominent companies like Google, Meta, Goldman Sachs, and Microsoft, enriching our expertise in the field.

Previous Work:

Our trajectory at Chaos Labs is marked by pioneering work in DeFi, where we've devised groundbreaking solutions for our partners. We've collaborated with notable names in the industry, such as Aave, GMX, Benqi, dYdX, Uniswap, Maker, and many more. Discover more about our work in our Research and Blog sections.

- Quantitative Interest Rate Optimization Methodology (April ’23)

- Aave Stablecoin IR Curves Updates

- Venus IR Curve Recommendations

Chaos Labs & Radiant Collaboration

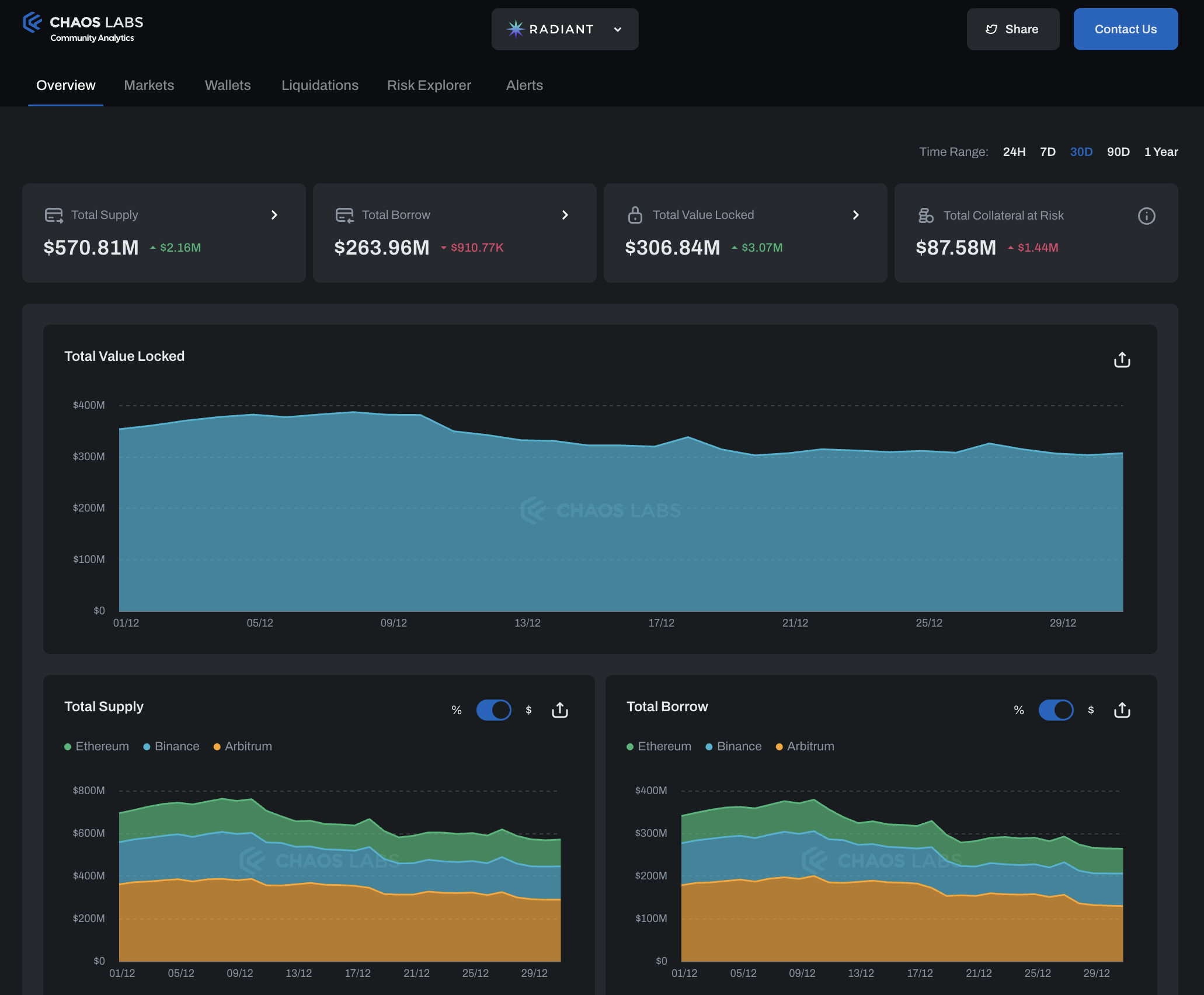

In July 2023, Chaos Labs introduced the Radiant Risk Monitoring and Alerting platform.

This platform, now supporting Arbitrum, BNB, and Ethereum deployments, provides comprehensive analytics and risk assessments of the Radiant protocol. It's a vital tool for strategic decision-making, offering insights into asset distributions and usage trends.

- A full video tutorial of the platform can be found here.

- A product run-through can be found in our blog post here.

Radiant Risk Hub view of Overview page

Motivation

Proactive interest rate curve adjustments are essential for the robustness and success of DeFi lending and borrowing protocols. In the volatile DeFi markets, characterized by rapid and unpredictable shifts, the ability to swiftly and strategically modify interest rates is crucial. For protocols like Radiant, this adaptability is key to remaining competitive and effective in an ever-evolving environment.

From a performance standpoint, proactive interest rate management is a significant factor in increasing a protocol's TVL and revenue. By optimizing utilization rates, it not only improves capital efficiency for suppliers but also encourages borrowing activities, contributing to the protocol’s financial growth. Additionally, these updates help Radiant to respond effectively to external market factors, keeping it in tune with the broader financial ecosystem. This ability to respond to market dynamics is critical for maintaining the protocol's appeal and competitive edge.

In essence, proactive interest rate curve updates are not just a strategic move; they are a fundamental necessity for the protocol's sustainability, competitiveness, and growth. They represent a commitment to adaptability, balance, and informed decision-making, all of which are indispensable in the fast-paced DeFi space.

Addressing the Core Challenges in Interest Rate Modeling

The current landscape of Interest Rate modeling in DeFi faces several critical challenges that our collaboration seeks to address:

- Generic Methodologies vs. Tailored Solutions: The prevalent use of one-size-fits-all methodologies for all assets, alongside ad-hoc solutions for specific cases, often fails to meet the diverse needs of different market segments.

- Theoretical Models vs. Real-World Variability: While existing solutions are often mathematically and logically sound, they frequently fall short in accounting for the unpredictability and variability inherent in real-life market behaviors.

- Adaptability to Rapid Market Changes: The dynamic nature of DeFi markets necessitates a more agile approach, as current models exhibit a limited ability to identify and adapt to swift changes within the industry.

Specification

Chaos Labs proposes a collaboration focused on proactive interest rate optimization for the Radiant protocol. Our collaborative effort is grounded in three fundamental pillars that set our approach apart:

-

Asset-Specialized Methodology for Interest Rate Modeling: We advocate for a more nuanced and asset-specific methodology, favoring tailored models that better align with the unique characteristics of various asset classes. As an example, stablecoins are highly sensitive to interest rate changes and are influenced by market conditions similar to traditional finance. Their rate adjustments significantly affect the dynamics of other cryptocurrencies. In contrast, LSTs show minimal interest rate sensitivity due to infrequent borrowing but have a notable impact on the borrowing rates of the underlying assets they collateralize. Therefore, a standardized approach to setting interest rates for all asset classes is not effective. Instead, a more nuanced approach is essential for optimal interest rate curve configuration.

-

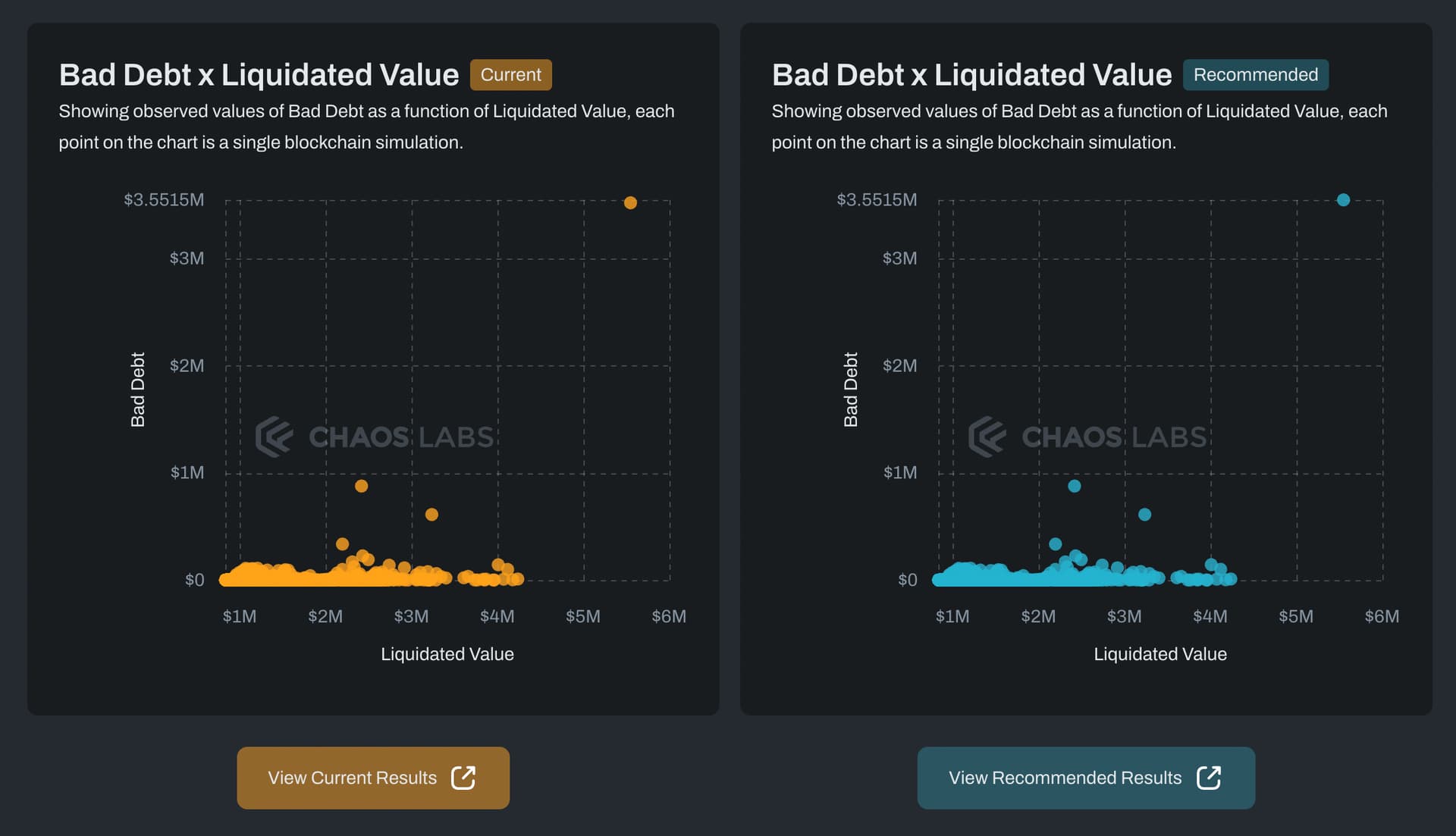

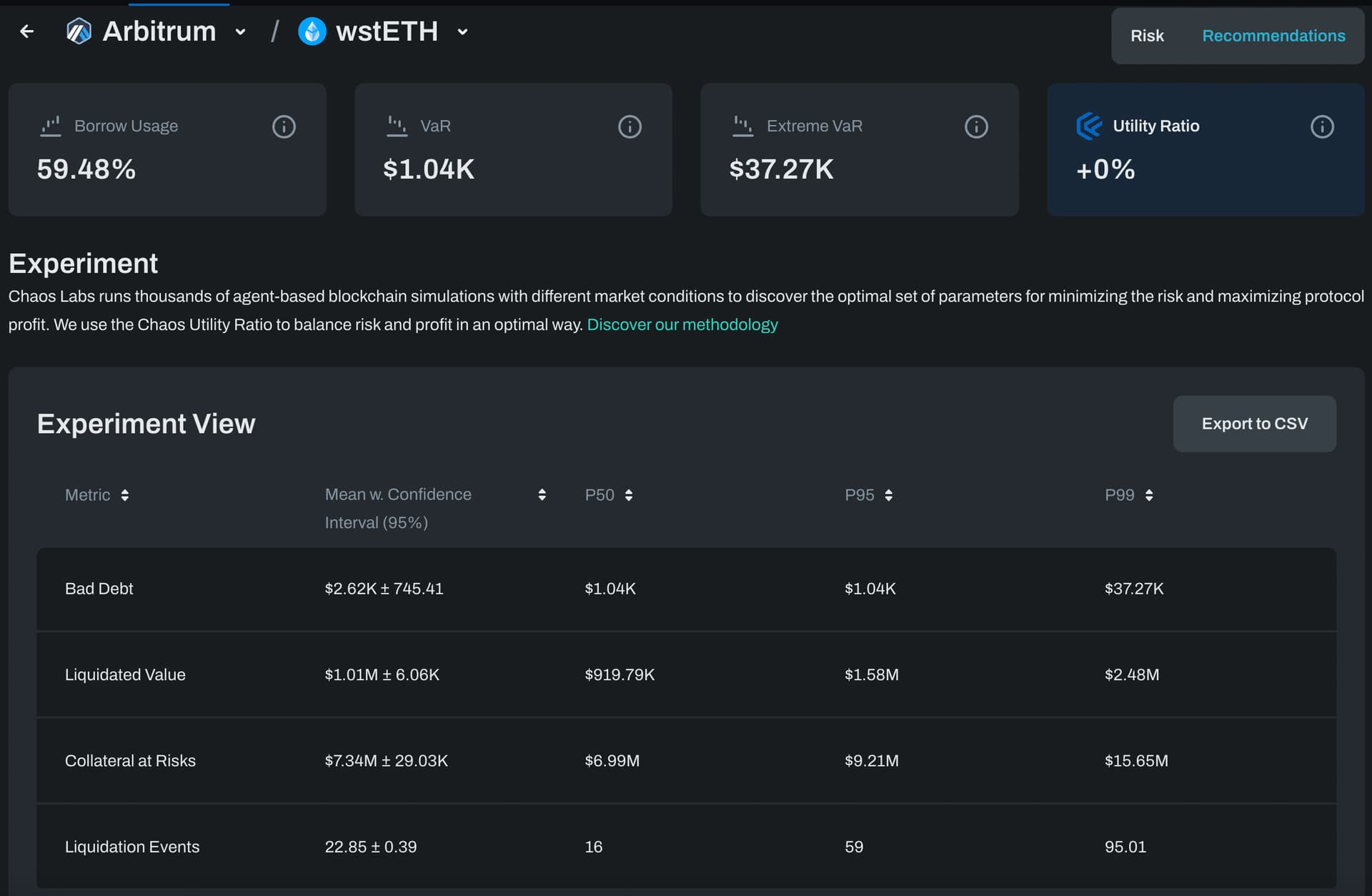

State-of-the-Art Simulation Engine: Our partnership leverages the best-in-class simulation engine, designed to accurately model and predict market dynamics, offering a more reliable foundation for decision-making. When evaluating changes in financial parameters, it's crucial to consider their impact across various potential futures. Simulation modeling, which leverages historical data, market trends, and user behavior, is key for predicting financial market reactions and aiding risk managers in making informed decisions. Chaos Labs employs cloud simulations to conduct extensive scenario analyses that mimic on-chain behavior, providing insights into how different circumstances might affect a protocol. This approach, ensuring scalability and up-to-date data, is vital for understanding and navigating the complexities of volatile financial environments.

Simulation results for Aave market on Arbitrum, balancing usage and minimizing bad debt.

Simulation results for Aave market on Arbitrum, balancing usage and minimizing bad debt. Experiment view showing detailed metrics of simulations run to better understand the risk boundaries of different alternatives.

Experiment view showing detailed metrics of simulations run to better understand the risk boundaries of different alternatives. -

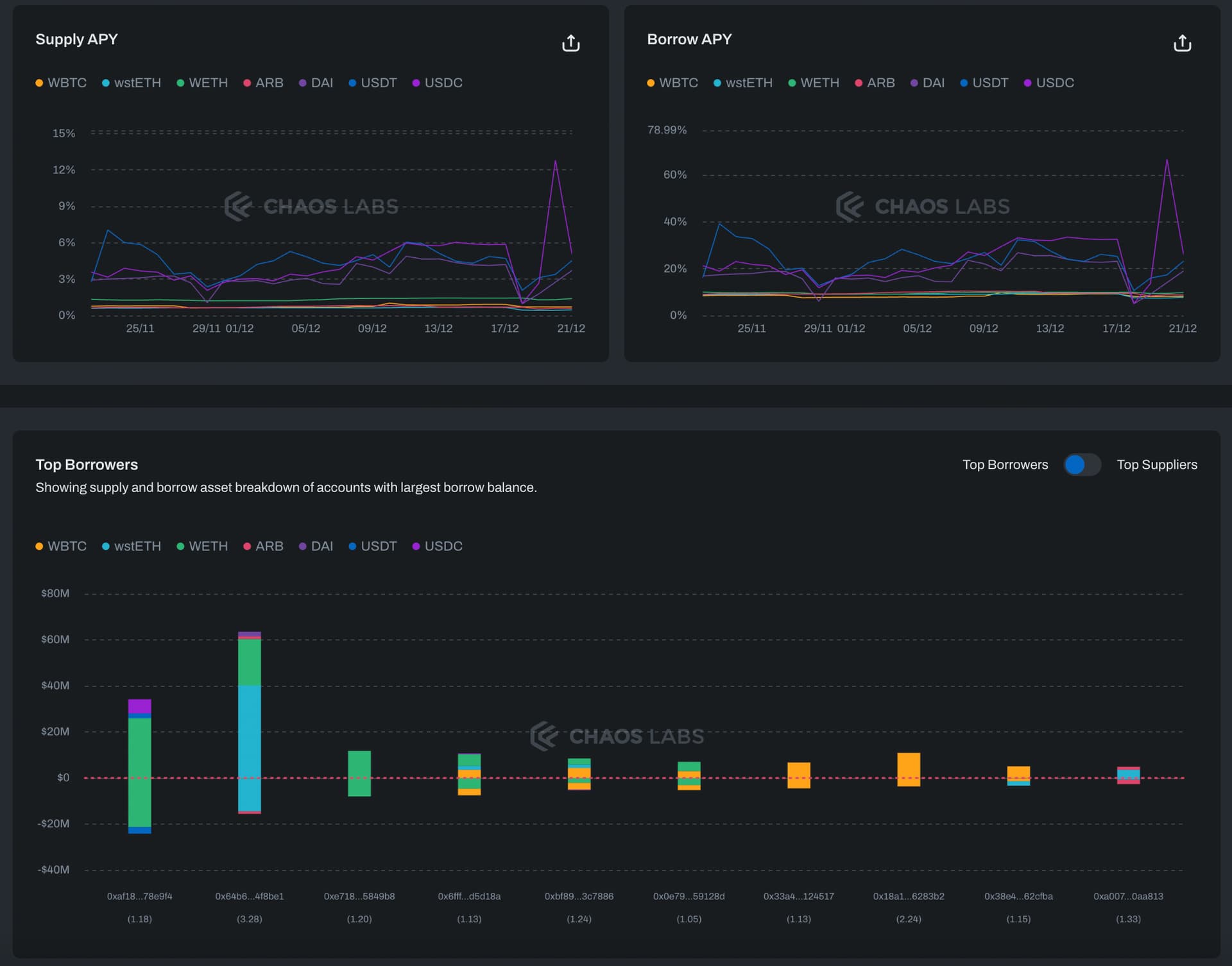

Industry Leading Monitoring and Observability Tools: To ensure continuous performance and adaptability, we integrate top-tier monitoring and observability tools, enabling real-time insights and proactive responses to market fluctuations. We propose expanding the existing Chaos Radiant Multi-Chain Risk Portal to support IR optimization.

Radiant Risk Hub current view of Interest Rates and borrower distribution

Engagement Scope

- In-depth Analysis of Historical IR Data and Market Comparisons:

- Rigorously research historical interest rate data across Radiant's deployments, coupled with a comprehensive competitive analysis in the market. This involves scrutinizing past interest rate trends and market responses and comparing them with competitors to identify best practices and areas for improvement.

- Scrutinize the existing state and recent trends within the lending markets on various Radiant deployments. Pinpoint the primary drivers of growth and articulate specific objectives for IR optimization on each deployment. This entails recognizing distinctive asset traits, user behaviors, and their influence on TVL and protocol revenue.

- Ongoing IR Recommendations

- Chaos Labs will provide regular, data-driven recommendations for interest rate adjustments, ensuring they align with market conditions, changes in user behavior, and the protocol's strategic objectives.

- As our recommendations are dynamically shaped based on market conditions and protocol activity, we do not establish a predetermined schedule for updates.

Timeline

At Chaos Labs, we are dedicated to forging lasting partnerships with premier DeFi protocols. In line with this commitment, we propose a 12-month partnership with Radiant for the above scope.

Cost

The total annual cost is set at $200,000, with payment options available in either stablecoins or RDNT tokens.

Payments to be made in equal quarterly installments, with each installment paid at the start of the quarter.

Voting

In Favor: Support the collaboration with Chaos Labs for optimizing and decentralizing interest rate curves within the Radiant protocol.

Against: Oppose the collaboration with Chaos Labs for this initiative.

Abstain: Neutral or undecided, contributing to the quorum nonetheless.

Off-Chain Vote

In Favor

10.56M RDNT80.9%

Against

2.27M RDNT17.4%

Abstain

217.3K RDNT1.7%

Quorum:131%

Timeline

Jan 18, 2024Proposal created

Jan 18, 2024Proposal vote started

Jan 21, 2024Proposal vote ended

Oct 11, 2024Proposal updated